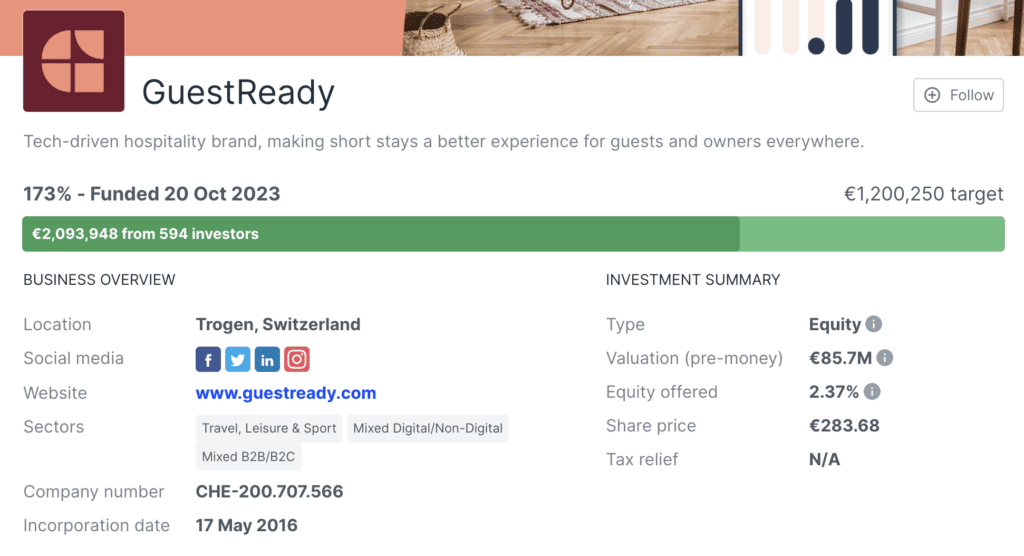

GuestReady‘s recent crowdfunding campaign in November 2023 marked a significant milestone in the European short-term rental market. On Seedrs, an equity crowdfunding platform, the company managed to raise an impressive €2,093,948 from 594 investors, following a similar campaign in late 2020, where they secured €2.4 million. This analysis delves into the released documents from the crowdfunding round to gain insights into GuestReady’s operational strategies, market footprint, and financial health.

Understanding Crowdfunding and Seedrs

Crowdfunding, a method of pooling resources from a large number of individual investors, often online, has been effectively utilized by GuestReady through Seedrs. Their recent campaign, where they significantly surpassed their initial fundraising goal, highlights the strong investor confidence in their business model and market potential.

In-Depth Analysis of GuestReady’s Business

- European Footprint: GuestReady manages over 6,000 properties in more than 30 cities across Europe. This extensive reach strategically targets major urban centers with high tourism and business travel demand, such as Paris, London, Lisbon, and Dubai, reflecting a strategic approach to capturing key segments of the European short-term rental market.

- Business Performance Metrics:

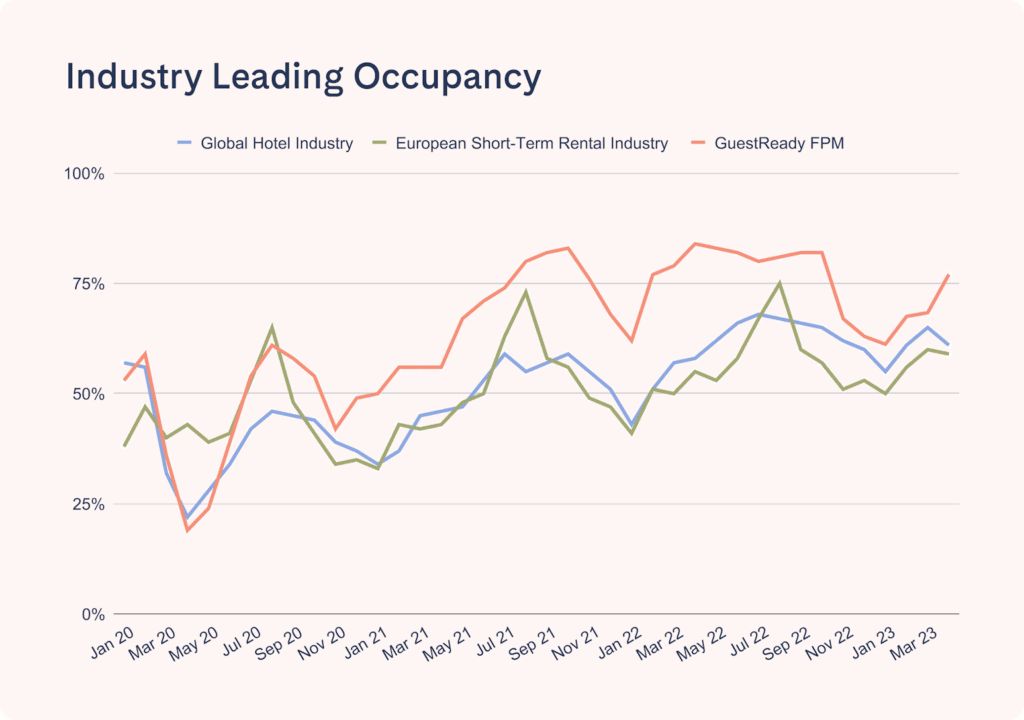

- Occupancy Rates: GuestReady’s occupancy rates consistently outperform the global hotel industry and European short-term rental benchmarks, signifying strong demand and effective property management.

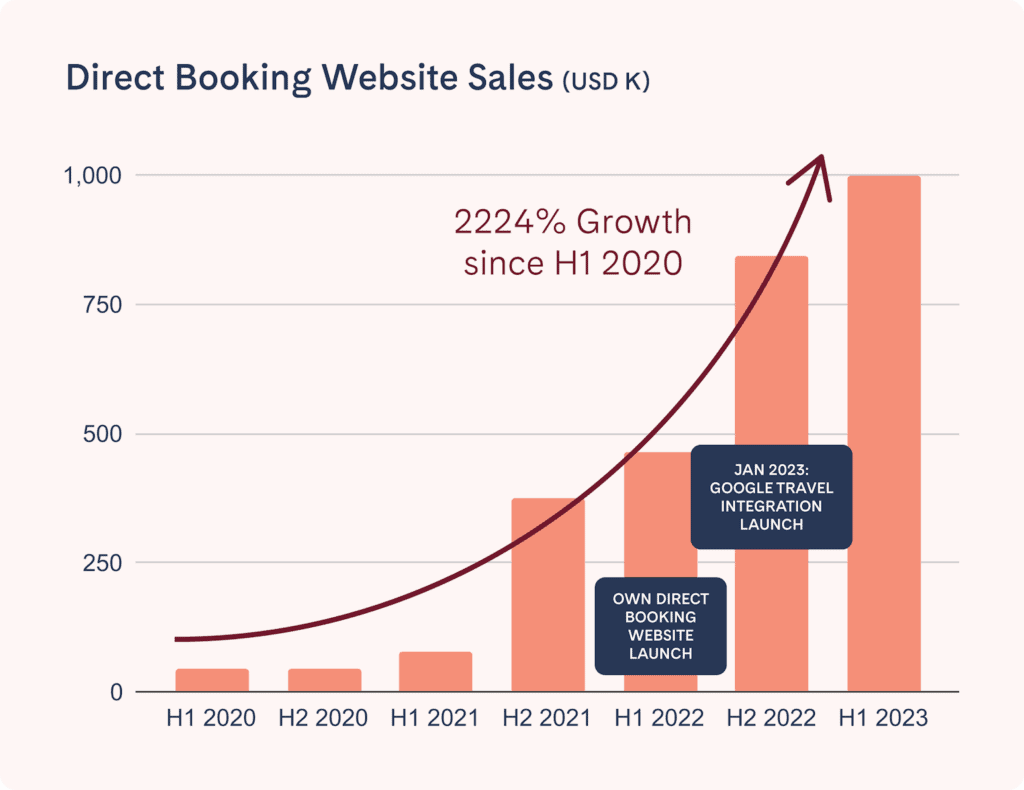

- Direct Booking Growth: The integration of their direct booking platform and partnership with Google Travel has led to a significant increase in direct booking revenues, marking a successful shift towards direct consumer engagement and brand loyalty.

- Property Management System (PMS) Business:

- RentalReady: Evolving from an internal tool to a SaaS offering for other property management firms, RentalReady represents a strategic diversification for GuestReady, broadening its revenue streams and positioning it as a technology provider in the property management space.

- Financial Performance:

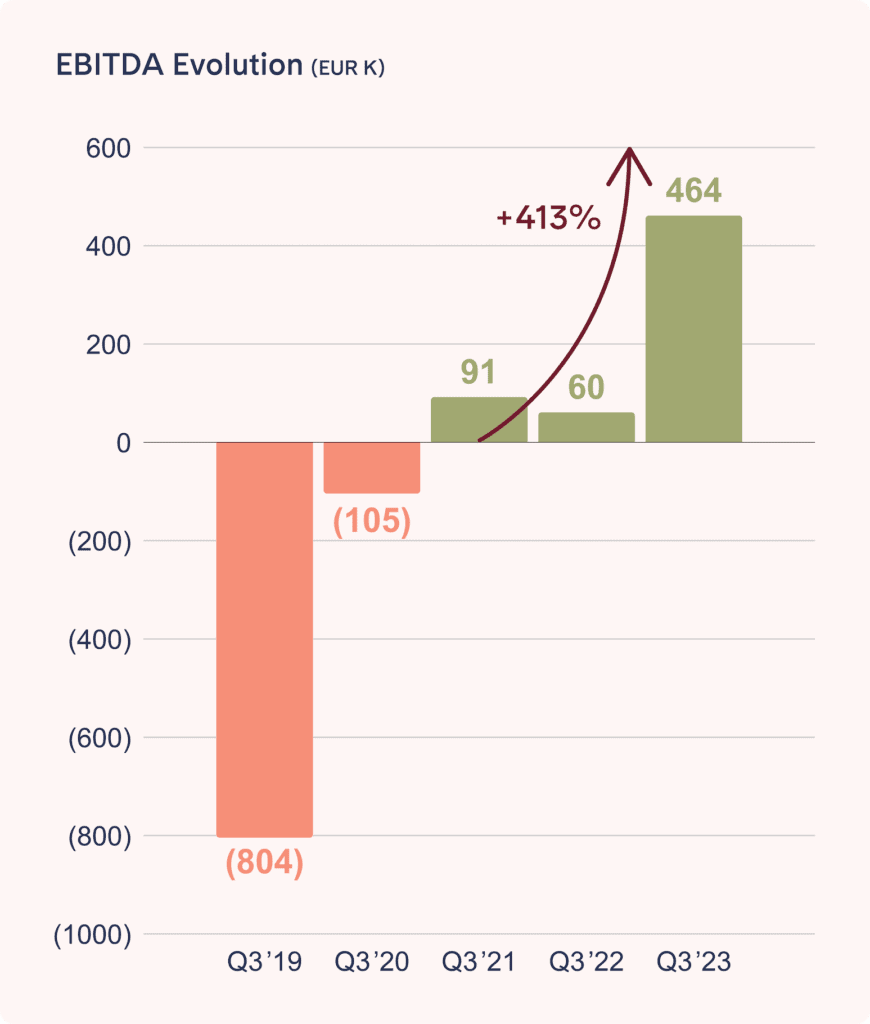

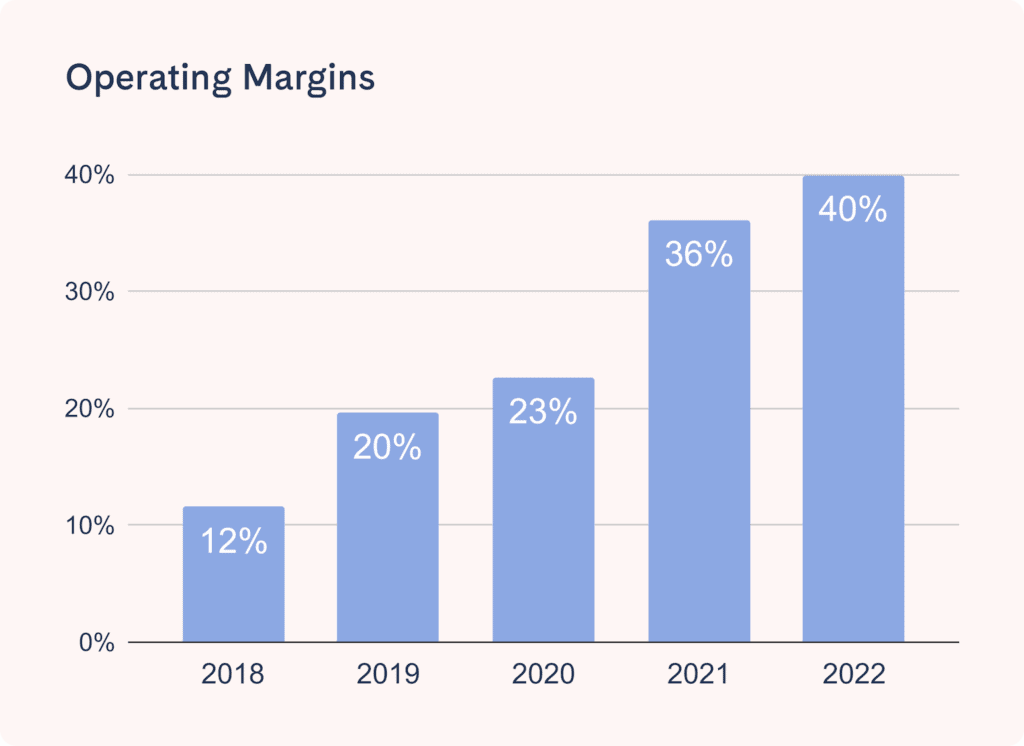

- EBITDA and Margins: The company’s EBITDA figures and operating and gross margins have shown substantial improvements, indicating strong operational performance, profitability, and efficient cost management.

Evolution of Business and Financial Metrics

- Growth in Managed Properties: GuestReady’s rapid increase in the number of properties under management signifies market acceptance and operational scalability.

- Revenue Trends: The company’s revenue growth aligns with the increase in managed properties and improved occupancy rates, suggesting a robust operational model.

- Investor Confidence: The oversubscription of their crowdfunding campaigns, first in late 2020 and again in 2023, reflects growing investor confidence in their growth potential and business resilience.

More about GuestReady from Rental Scale-Up

In previous Rental Scale-Up articles, we have highlighted GuestReady’s strategic approach to crowdfunding, where early backing from major investors creates a positive momentum for additional investments.

Last year, we interviewed GuestReady CEO Alexander Limpert, discussing the operational efficiencies and strategies that have propelled the company’s growth in the short-term rental property management sector. Key points from the interview include:

- Role of Technology: Initially, GuestReady relied on third-party tech tools but eventually developed a comprehensive in-house solution. This shift was influenced by the founders’ previous experience at Foodpanda and allowed for more cost-effective and flexible operations.

- Specialized Teams: GuestReady attributes part of its success to having specialized teams for various operations like staging, maintenance, and guest experience. Effective communication and documentation within these teams are emphasized to avoid silos and ensure clear expectations.

- Three Ps Strategy: The company focuses on People, Processes, and Product, ensuring each is scalable and rigid across different regions. This structure includes global teams with functional expertise and local teams understanding market specifics, working together for optimal value delivery.

- Labor Challenges: Addressing the industrywide labor shortage, particularly in the UK, GuestReady has leveraged its maturing technology to mitigate this issue, reducing dependence on manual labor and adjusting to rising costs.

- RentalReady Software: Developed based on GuestReady’s operational needs, RentalReady is a comprehensive tool designed by property managers for property managers, offering features like 24/7 guest support.

Conclusion

GuestReady’s success in the November 2023 Seedrs campaign, raising €2,093,948 from 594 investors, is a testament to the company’s strong position in the competitive short-term rental market. Their strategic expansion, technological investments, and robust financial management paint a picture of a company experiencing dynamic growth and adapting to the evolving challenges of the short-term rental industry. The comprehensive data from their crowdfunding documents provides an in-depth view of GuestReady’s operational efficiency, market penetration, and financial stability.

![Trump-Era Policies Fuel Travel Uncertainty: Fewer Canadians, Europeans to U.S.—Fewer Americans to Europe [Early Data]](https://www.rentalscaleup.com/wp-content/uploads/2025/04/Trump-Era-Policies-Fuel-Travel-Uncertainty-Fewer-Canadians-Europeans-to-U.S.—Fewer-Americans-to-Europe-Early-Data-150x150.jpg)